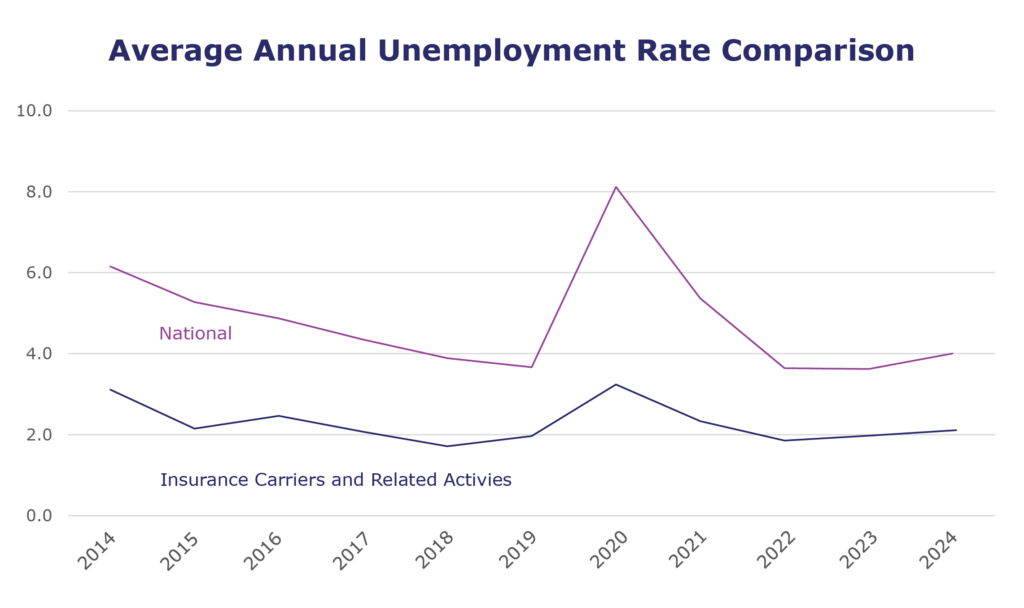

While the insurance carriers and related activities sector saw an uptick in unemployment for August, the next few months will reveal whether this is a notable trend. The industry experienced two similar spikes last year, in December (to 3.4%) and in June (to 3.2%). However, in both instances the unemployment rate quickly lowered back to its more typical 1.5-2% range.

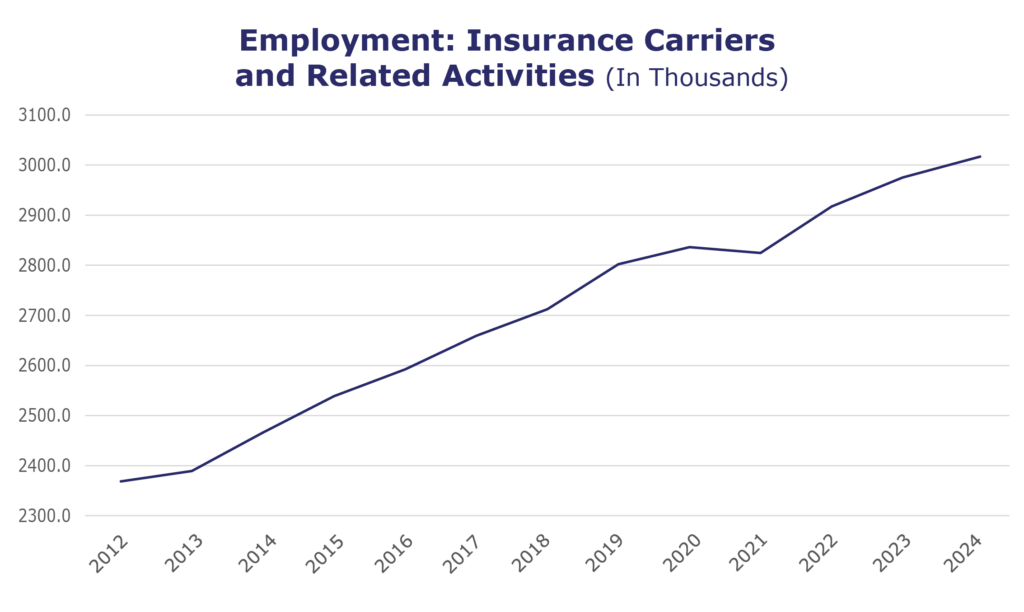

Industry employment is continuing to grow, and hit a new peak in August, with July* numbers showing agents and brokers are experiencing the highest percentage of both month-to-month and year-to-year job growth. For the larger finance and insurance industry, July* saw an increase in both retirements and layoffs, as well as hires.

For insight on what you can expect for the remainder of the year and into 2025, view our Q3 2024 Insurance Labor Market Study Results.

| Unemployment for the insurance carriers and related activities sector increased to 3.1% in August. | |

| The insurance carriers and related activities sector gained 3,300 jobs in August. | |

| At more than 3 million jobs, industry employment increased by approximately 42,500 jobs compared to August 2023. | |

| The U.S. unemployment rate slightly decreased to 4.2% in August and the overall economy added 142,000 jobs. |

- On a year-to-year basis, July* insurance industry employment saw job increases in agents/brokers (up 3.4%), reinsurance (up 1.3%), claims (up 0.6%), life/health (up 0.5%), TPAs (up 0.5%), and property and casualty (up 0.5%). Meanwhile, jobs decreased in title (down 2.3%).

- On a year-to-year basis, July* saw weekly wage increases in reinsurance (up 11.4%), title (up 9.8%), TPAs (up 8.6%), agents/brokers (up 8%), claims (up 6.5%), life/health (up 3.1%) and property and casualty (up 0.3%).

BLS Reported Adjustments:

Adjusted employment numbers for July show the industry saw an increase of 3,300 jobs, compared to the previously reported increase of 2,700 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.