The results are in!

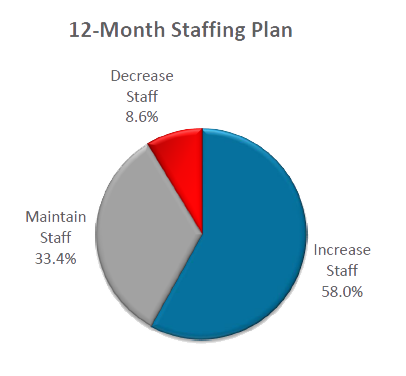

The results from our third quarter iteration of the U.S. Insurance Labor Outlook Study are now available. Compared to the January 2014 survey, the rate of expected hiring experienced a slight decrease, down to 58%; however, this remains the second highest reading since we started the semi-annual survey back in 2009. In addition, unemployment continues to be low, with the BLS reporting the August 2014 rate for insurance at 2.4%. The industry is clearly enjoying an extended period of relative stability.

The results from our third quarter iteration of the U.S. Insurance Labor Outlook Study are now available. Compared to the January 2014 survey, the rate of expected hiring experienced a slight decrease, down to 58%; however, this remains the second highest reading since we started the semi-annual survey back in 2009. In addition, unemployment continues to be low, with the BLS reporting the August 2014 rate for insurance at 2.4%. The industry is clearly enjoying an extended period of relative stability.

However, the optimism surrounding the low unemployment and continued focus on hiring is clouded by a diminishing talent pool and increased recruiting difficulty. The industry has seen growth of more than 51,000 new positions since its low in April 2011, reaching 1,471,600 total employees in July 2014—the highest the industry has seen since 2008. Already companies are reporting difficulty in recruiting, and that is only expected to increase as the available talent pool continues to shrink.

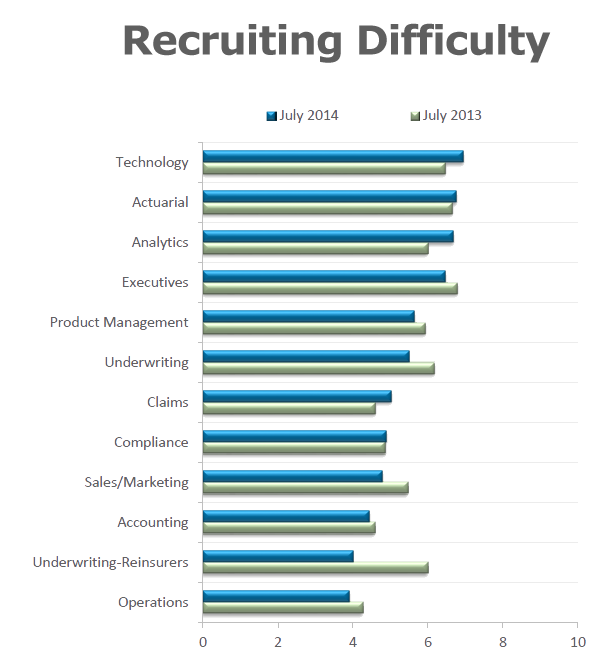

Industry wide, technology, claims, underwriting and analytics positions continue to be the most in demand. This matches the growing focus on big data and technology within the industry. Due in part to their high demand, technology, actuarial, analytics and claims positions were reported to be more difficult to fill than in past years. It is expected that this demand will continue to grow as technology permeates throughout the insurance industry. Consider also the 211,000 currently open jobs across the industry, and it is easy to predict that recruitment for most insurance roles will become more and more challenging.

Industry wide, technology, claims, underwriting and analytics positions continue to be the most in demand. This matches the growing focus on big data and technology within the industry. Due in part to their high demand, technology, actuarial, analytics and claims positions were reported to be more difficult to fill than in past years. It is expected that this demand will continue to grow as technology permeates throughout the insurance industry. Consider also the 211,000 currently open jobs across the industry, and it is easy to predict that recruitment for most insurance roles will become more and more challenging.

This renewed hiring push coupled with already low industry unemployment and an aging workforce presents a demand for talent that is far surpassing the current supply. Currently, 20% of the industry workforce is nearing retirement—a number that is expected to grow to 25% by 2018. The tightening labor market is making it very difficult for organizations to combat the talent shortage brought on by the growing number of retirements.

In order to meet the growing industry need, organizations must look toward building their current talent pipelines. Fortunately, the influx of Millennials into the workforce provides a solution. Already, Millennials make up 25% of the workforce. That number is expected to double by 2020. These young professionals are tech savvy, innovative and seek a job that allows them to make a difference—all ambitions supported by a career in insurance. The focus now must shift to engaging and recruiting this talented generation. Focus on promoting the benefits of working within the industry and touting the unique opportunities offered, including the nobility of the profession, competitive compensation and historically low unemployment compared to the national average.

The industry cannot be lulled into a fall sense of security by the current market stabilization. We must look to the future as the talent storm continues to strengthen. Only by preparing today, keeping one step ahead and building a bench of talented professionals, can insurance successfully weather the storm.

Is your organization prepared for the growing talent shortage?