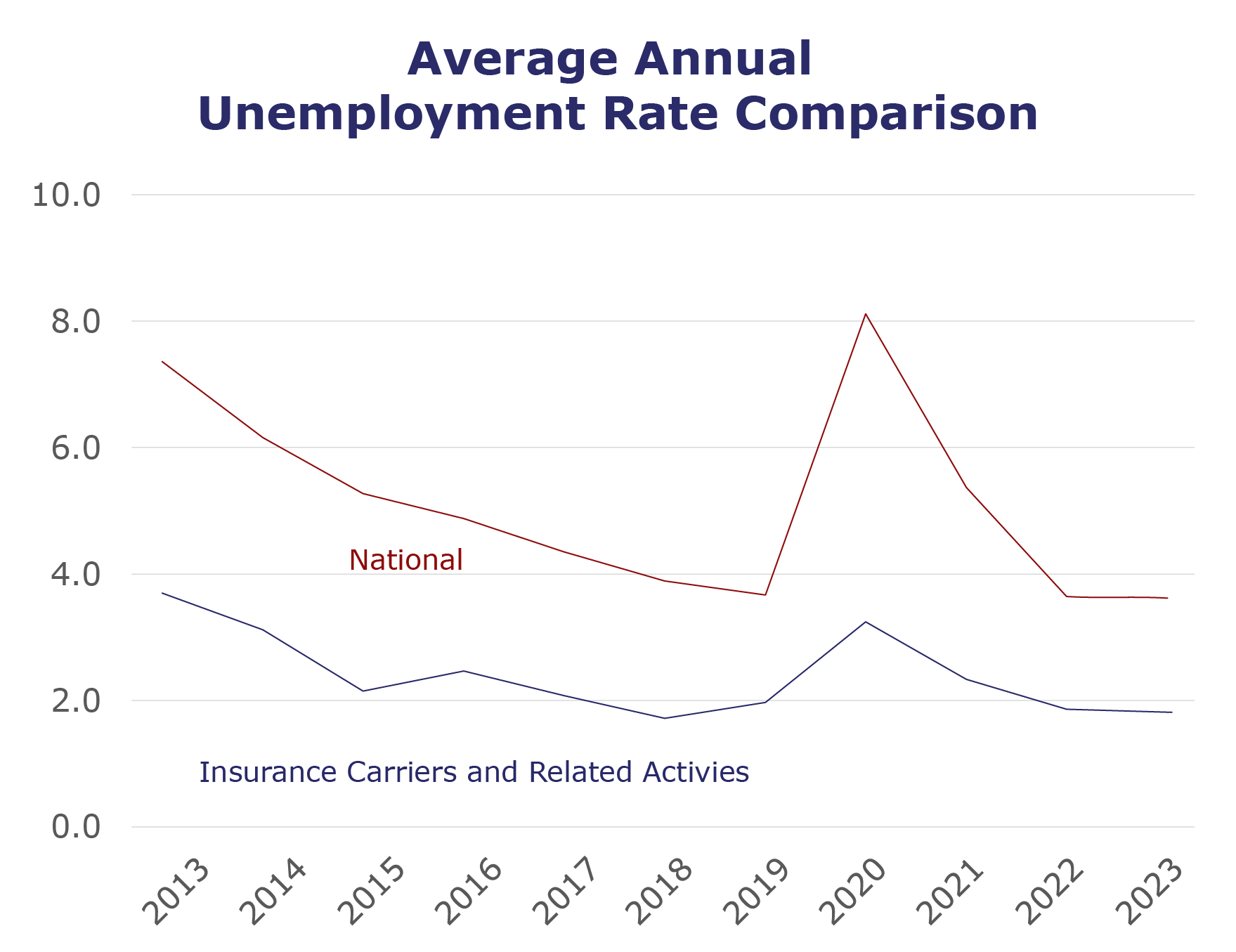

While the unemployment rate for insurance carriers and related activities rose slightly in October, it remains low at 1.7%. At the same time, job openings for the larger finance and insurance sector are at their highest level since July 2022, reaching 479,000 in September* (nearly 200,000 more open positions than reported for September 2022, which saw a notable drop). Even as overall movement within the industry appears to be stabilizing, low unemployment and an abundance of opportunities means there’s continued competition for talent, making retaining current employees even more important.

| Unemployment for the insurance carriers and related activities sector increased to 1.7% in October. | |

| The insurance carriers and related activities sector gained 1,100 jobs in October. | |

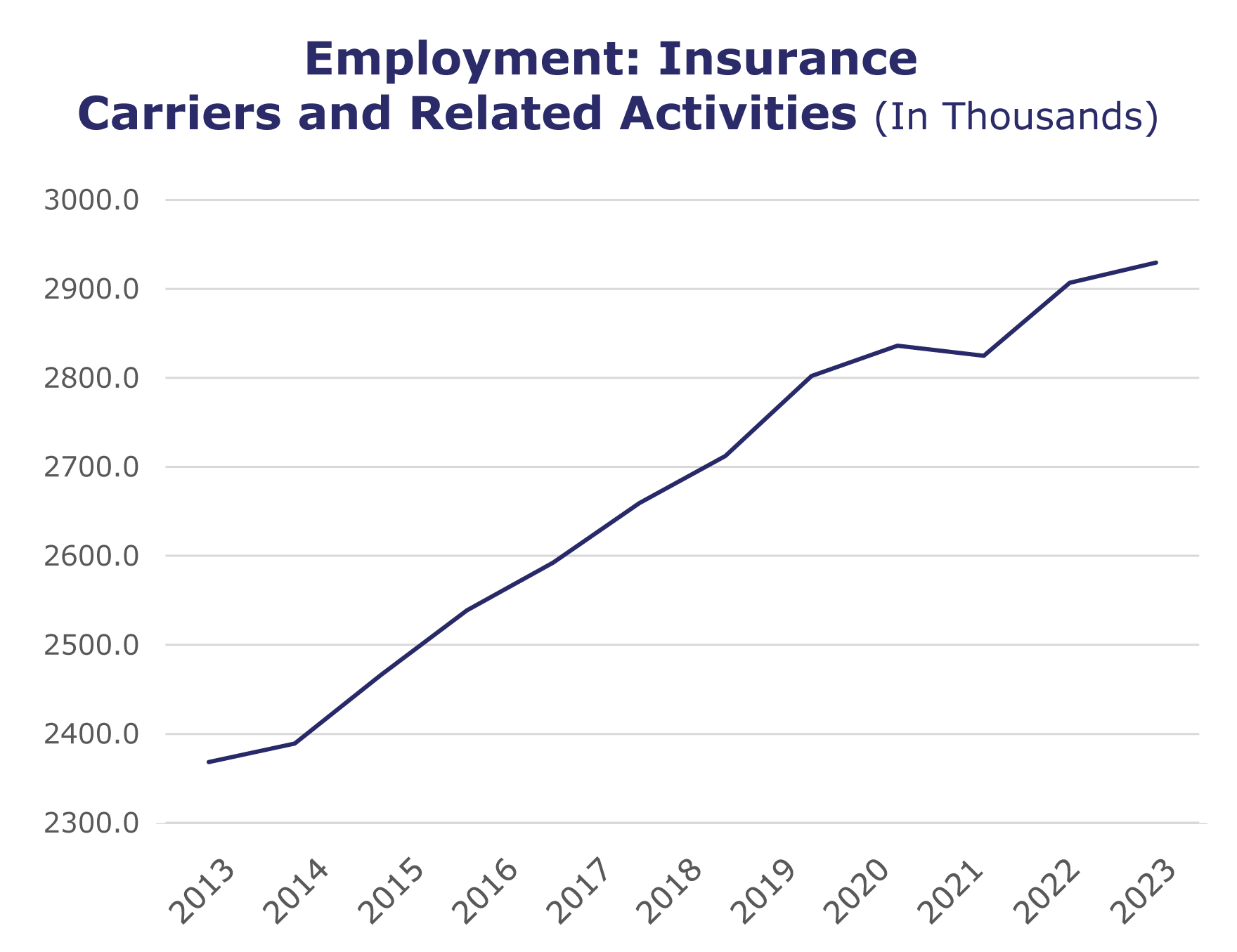

| At nearly 3 million jobs, industry employment increased by approximately 36,600 jobs compared to October 2022. |

|

| The U.S. unemployment rate slightly increased to 3.9% in October and the overall economy added 150,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, September* insurance industry employment saw job increases in TPAs (up 3.5%), reinsurance (up 2.6%), claims (up 2.5%), life/health (up 1.9%), agents/brokers (up 1.4%), and property and casualty (up 0.5%). Meanwhile, jobs decreased in title (down 8.2%).

- On a year-to-year basis, September* saw weekly wage increases in title (up 9.8%), property and casualty (up 9%), agents/brokers (up 5.4%), life/health (up 4.9%), TPAs (up 4.4%), and claims (up 3.9%). Meanwhile, wages decreased in reinsurance (down 4.1%).

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.