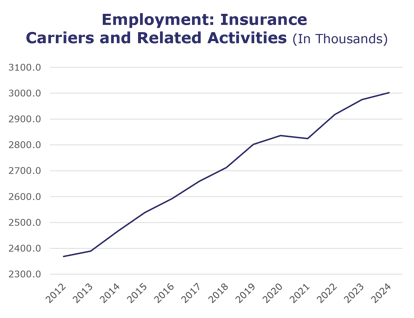

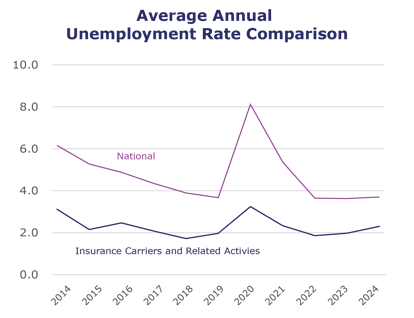

We’re closing out the first quarter of 2024 on a positive note. Unemployment for the insurance carriers and related activities sector slightly dropped to 2% and industry employment continues to grow – reaching a new record high in February. Job openings for the larger finance and insurance industry are the highest they’ve been since September 2023, which hit a record of 509,000 open roles, according to revised numbers from the Bureau of Labor Statistics.

According to our Q1 2024 Insurance Labor Market Study, conducted in partnership with Aon plc, 52% of carriers are planning to add staff in 2024 and just 10% plan to decrease their staff sizes. While insurers are acting with more caution than we’ve seen in the past few years, the industry is continuing to grow. For more insights on what to expect this year, view our full results summary.

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, January* insurance industry employment saw job increases in claims (up 5.1%), reinsurance (up 3.7%), agents/brokers (up 2.5%), TPAs (up 1.9%), life/health (up 1%), and property and casualty (up 0.1%). Meanwhile, jobs decreased in title (down 3.2%).

- On a year-to-year basis, January* saw weekly wage increases across all areas: title (up 9.8%), agents/brokers (up 7%), TPAs (up 6.5%), reinsurance (up 5.9%), life/health (up 5.1%), property and casualty (up 4.7%), and claims (up 3.7%).

BLS Reported Adjustments:

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.