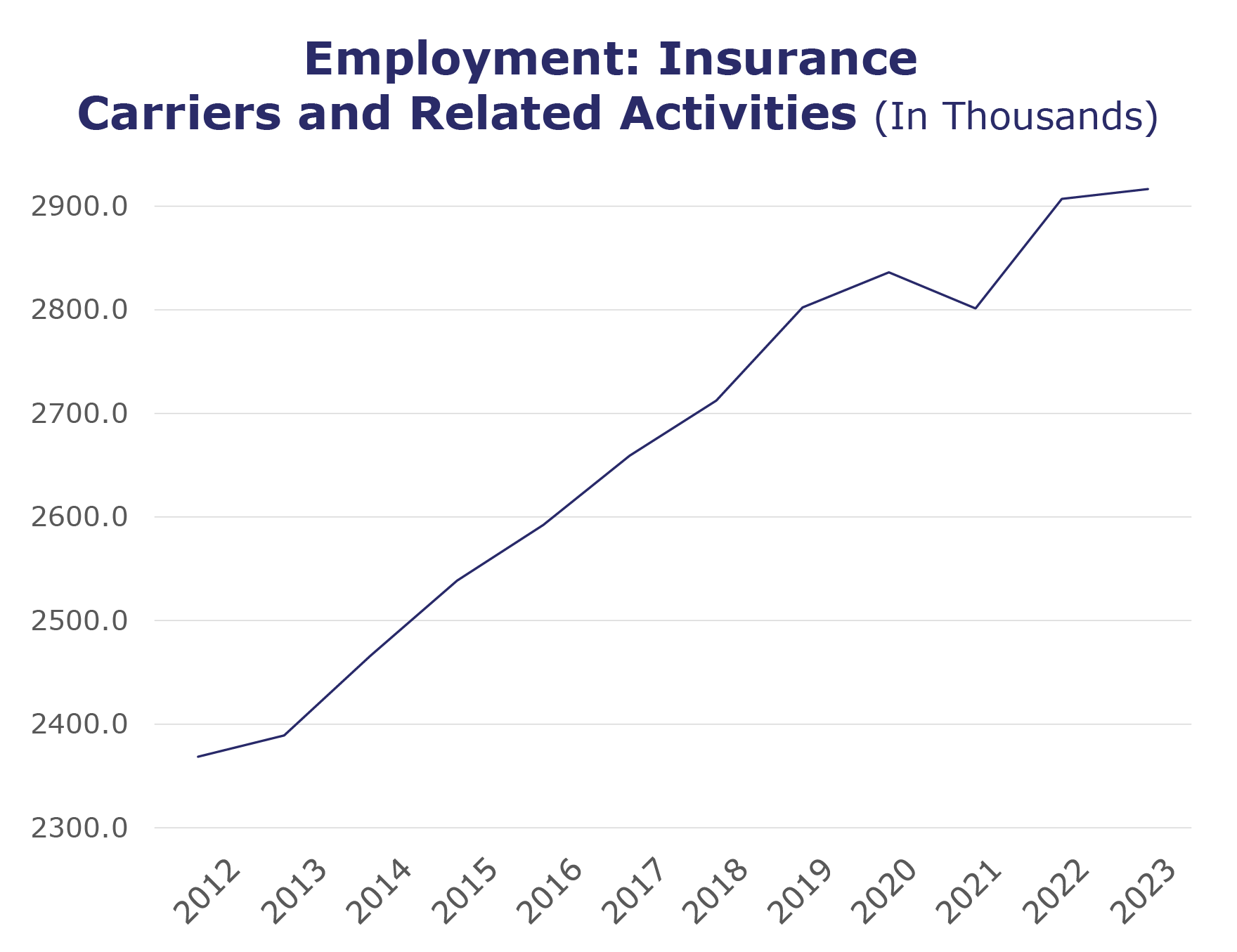

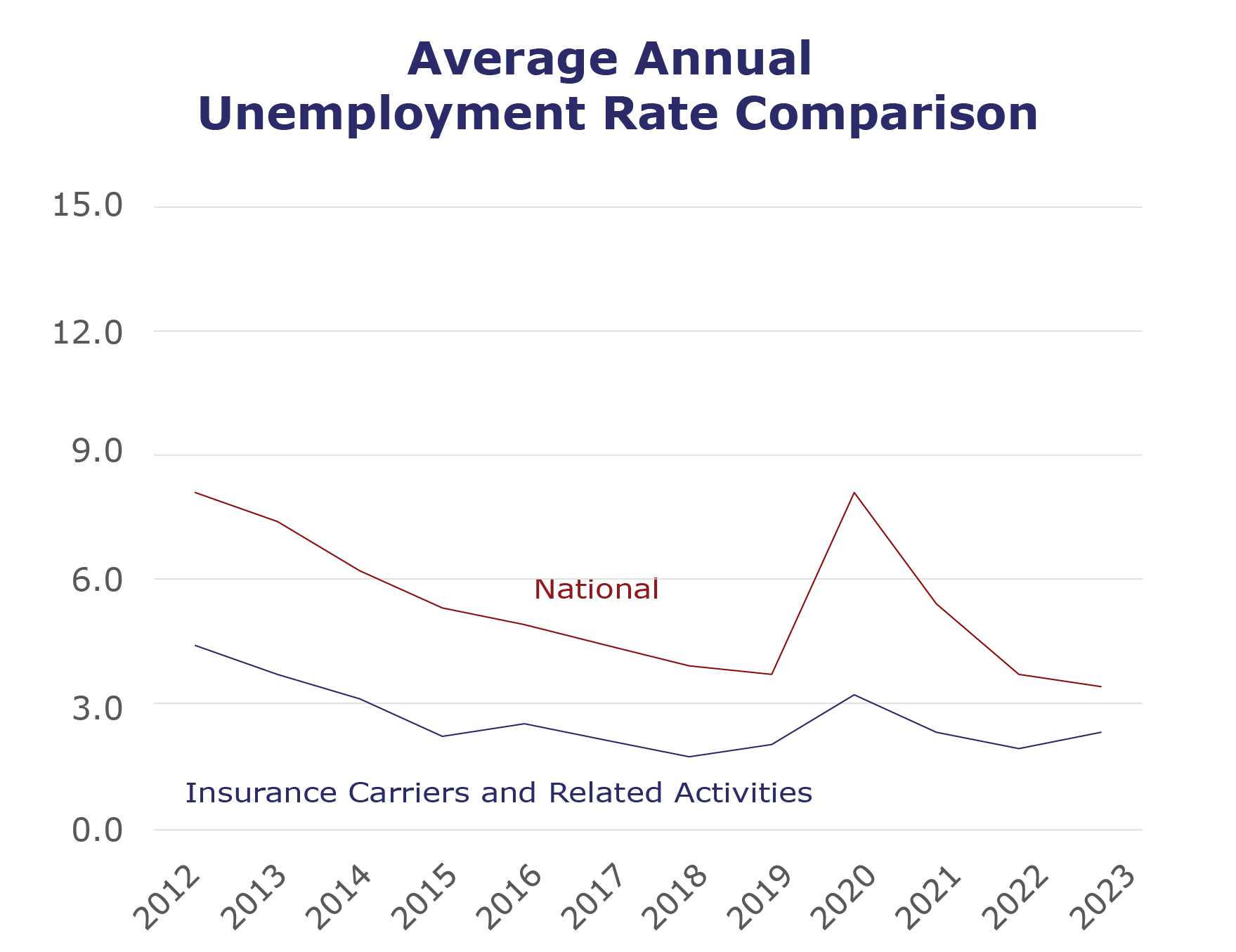

The insurance labor market continued its steady growth in February with unemployment falling almost a full point to 1.4% for insurance carriers and related activities. Revised numbers for January also show the industry hit record-high employment at 2,922,000 jobs.

The insurance labor market continued its steady growth in February with unemployment falling almost a full point to 1.4% for insurance carriers and related activities. Revised numbers for January also show the industry hit record-high employment at 2,922,000 jobs.

For more insights on hiring trends and the outlook for 2023, view our infographic highlighting the results of our recent Semi-Annual Insurance Labor Market Study.

AT-A-GLANCE NUMBERS

| Unemployment for the insurance carriers and related activities sector decreased to 1.4% in February. | |

| The insurance carriers and related activities sector lost 4,200 jobs in February. | |

| At roughly 2.9 million jobs, industry employment increased by approximately 35,500 jobs compared to February 2022. | |

| The U.S. unemployment rate increased to 3.6% in February and the overall economy added 311,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, January** insurance industry employment saw job increases in property and casualty (up 3.6%), TPAs (up 3.3%), agents/brokers (up 2.7%), life/health (up 1.6%), and reinsurance (up 1.4%). Meanwhile, job decreases were seen in title (down 11.6%) and claims (down 8.3%).

- On a year-to-year basis, January** saw weekly wage increases in all categories: property and casualty (up 10.2%), life/health (up 5.8%), title (up 5.8%), TPAs (up 4.8%), agents/brokers (up 4.8%), claims (up 1.3%) and reinsurance (up 0.3%).

*The BLS made its annual revisions on February 3, adjusting current employment statistics numbers for the past five years.

**The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.