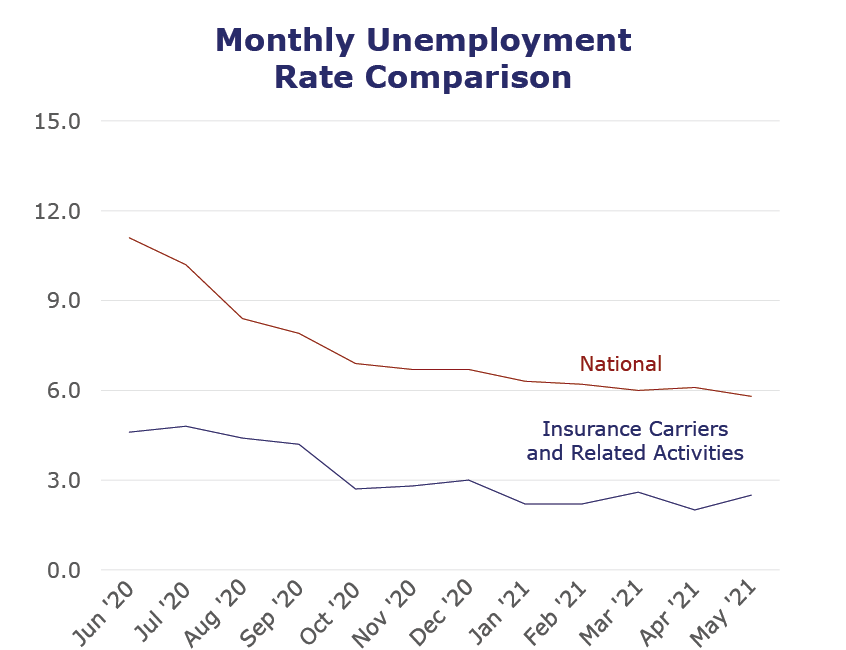

Unemployment for the insurance carriers and related activities sector rose slightly in May to 2.5%. While the insurance industry as a whole has lost 15,000 jobs since February, the average unemployment rate for 2021 so far is a mere 2.3%. Property and casualty, and life and health carriers have seen the bulk of the job losses at 4,000 each.

The job losses may be, in part, due to the difficulty carriers are experiencing filling positions given the low unemployment and the fact that the number of job openings in finance and insurance are increasing. While this is certainly something to watch, we’re optimistic the numbers will be less drastic once the final adjusted BLS numbers are released, as is often the case.

The overall U.S. economy continued its slow, but steady recovery in May with the unemployment rate dropping to 5.8%. This is the lowest overall unemployment rate since pre-pandemic March 2020 at 4.4%.

As the country continues toward its goal of being fully “open,” it’s likely work arrangements and differences in expectations between workers and employers will affect job openings, turnover rates and possibly even unemployment levels.

| Unemployment for the insurance carriers and related activities sector increased to 2.5% in May. | |

| The insurance carriers and related activities sector lost 4,800 jobs in May. | |

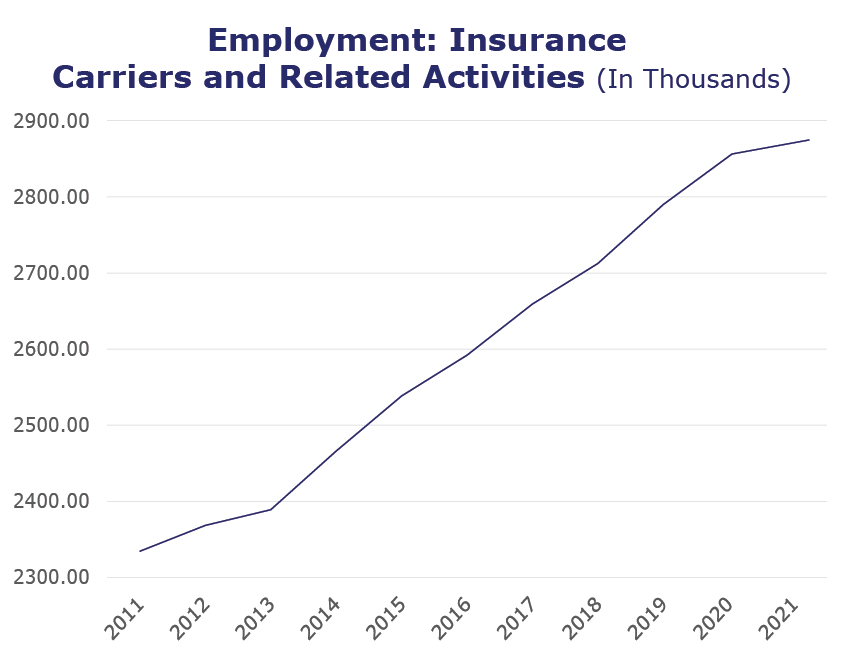

| At roughly 2.8 million jobs, industry employment increased by approximately 16,300 jobs compared to May 2020. | |

| The U.S. unemployment rate decreased to 5.8% in May and added 559,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, April* insurance industry employment saw job increases in title (up 12.9%), agents/brokers (up 2.7%), claims (up 1.5%) and life/health (up 0.1%). Meanwhile, job decreases were seen for reinsurance (down 4%), TPAs (down 3.5%) and property and casualty (down 1.2%).

- On a year-to-year basis, April* saw weekly wage increases in reinsurance (up 13.1%), agents/brokers (up 4.2%), life/health (up 3.1%), property and casualty (up 2.8%), title (up 1.3%) and claims (up 0.5%). Meanwhile, wage decreases were seen for TPAs (down 1.8%).

BLS Reported Adjustments: Adjusted employment numbers for April show the industry saw a decrease of 9,400 jobs, compared to the previously reported decrease of 7,000 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.