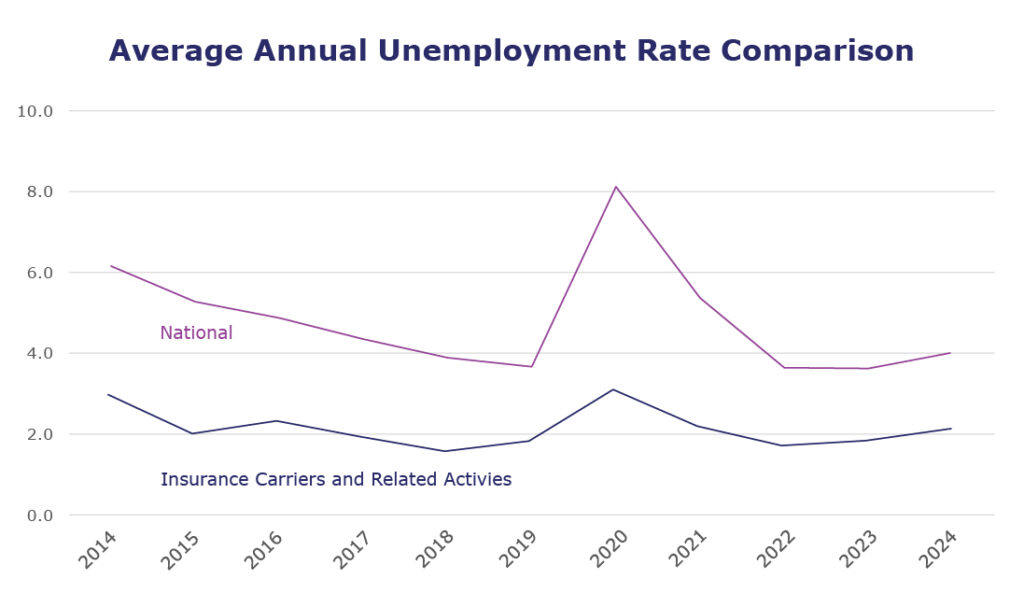

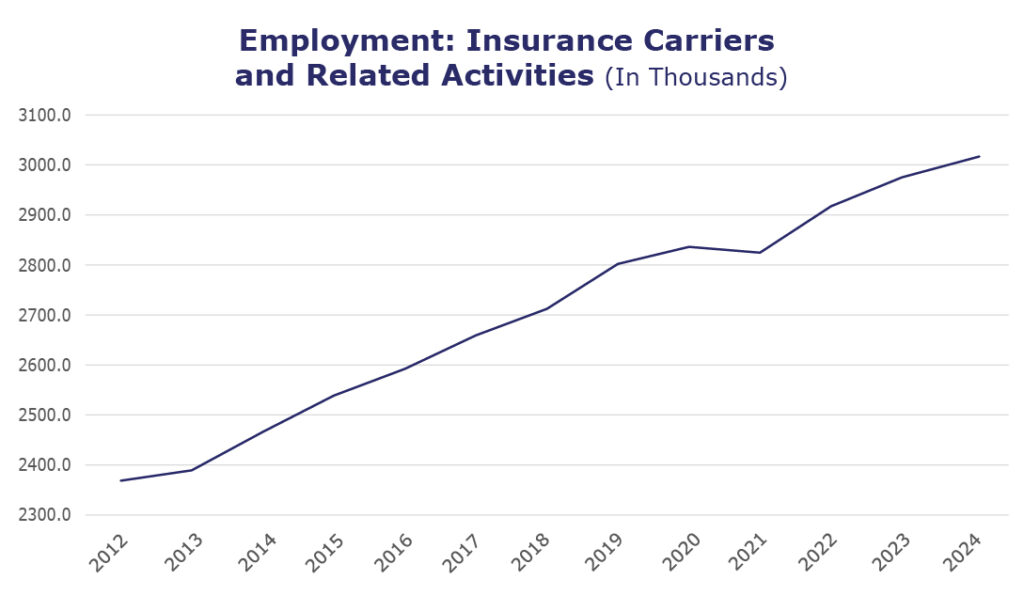

The industry remains stable moving into the new year, adding 52,700 jobs throughout 2024 and continuing its steady post-pandemic growth. Despite slight spikes in December and August, the annual average unemployment rate for insurance carriers and related activities in 2024 was 2.1%, similar to 2023’s average of 2%. While insurance unemployment reached 3.2% in December 2024, this is consistent with both December 2022 (which saw an unemployment rate of 3.5%) and December 2023 (which hit 3.4%), both of which quickly dropped back down.

Demand for talent persists and next month marks the 10th annual Insurance Careers Month, where the industry comes together to amplify why insurance is a career of choice. Learn more and start planning your organization’s involvement: https://insurancecareersmovement.org/february-insurance-careers-month/.

Additionally, the Q1 2025 Insurance Labor Market Study, conducted by Jacobson and Aon plc, is now open for participation. Share your plans for the next 12 months and gain access to the results: https://jcbsn.gr/2025q1-laborstudy.

| Unemployment for the insurance carriers and related activities sector increased to 3.2% in December. | |

| The insurance carriers and related activities sector gained 13,300 jobs in December. | |

| At more than 3 million jobs, industry employment increased by approximately 52,700 jobs compared to December 2023. | |

The U.S. unemployment rate decreased to 4.1% in December and the overall economy added 256,000 jobs. |

- On a year-to-year basis, November* insurance industry employment saw job increases in all categories: agents/brokers (up 3.2%), reinsurance (up 2.6%), claims (up 2.6%), title (up 2.3%), TPAs (up 1.0%), property and casualty (up 0.5%) and life/health (up 0.4%).

- On a year-to-year basis, November* saw weekly wage increases in all categories: TPAs (up 9.9%), agents/brokers (up 7.4%), title (up 5.7%), reinsurance (up 4.7%), property and casualty (up 4.2%), claims (up 3.9%) and life/health (up 1.4%).

BLS Reported Adjustments:

Adjusted employment numbers for November show the industry saw an increase of 5,200 jobs, compared to the previously reported increase of 5,100 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.