The results from our latest Semi-Annual U.S. Insurance Labor Outlook Study are now in!

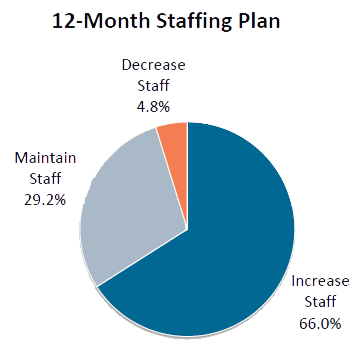

The survey expectations are overwhelmingly positive for staffing and revenue growth. Compared to the July 2014 survey, the rate of expected hiring jumped to 66 percent—the highest percentage since the survey began in 2009. Nearly one-third of all companies are planning to increase their staff by at least 2 percent in the coming year. Primary drivers for this growth in staffing are the anticipated increase in business volume and the expansion of business into new markets. The post-recession recovery continues to effect staffing expectations as more than 40 percent of organizations reported that they would be hiring to fill areas currently understaffed.

The survey expectations are overwhelmingly positive for staffing and revenue growth. Compared to the July 2014 survey, the rate of expected hiring jumped to 66 percent—the highest percentage since the survey began in 2009. Nearly one-third of all companies are planning to increase their staff by at least 2 percent in the coming year. Primary drivers for this growth in staffing are the anticipated increase in business volume and the expansion of business into new markets. The post-recession recovery continues to effect staffing expectations as more than 40 percent of organizations reported that they would be hiring to fill areas currently understaffed.

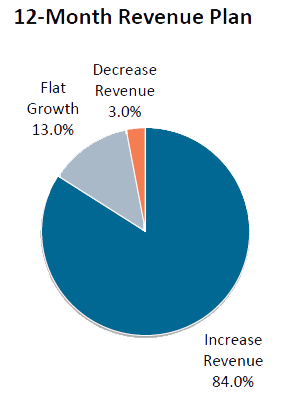

Revenue growth expectations remain high, with 84 percent of surveyed organizations expecting an increase in revenue growth in 2015. This is the fourth highest level since the survey began, however it marks a slight decrease from the expectations reported in July 2014. An increase in market share and changes in pricing are driving the expected revenue increase within the industry.

Revenue growth expectations remain high, with 84 percent of surveyed organizations expecting an increase in revenue growth in 2015. This is the fourth highest level since the survey began, however it marks a slight decrease from the expectations reported in July 2014. An increase in market share and changes in pricing are driving the expected revenue increase within the industry.

Despite this positive outlook, insurers face an increasingly challenging labor market as the demand for talent continues to far surpass the current supply. Since its low in April 2011, the industry has seen a growth of more than 60,200 new jobs. In January 2015, staffing in insurance reached 1,481,000—the highest the industry has seen since July 2004. Add in 236,000 job openings within insurance and it is clear that the labor market is in the midst of a drastic tightening.

In addition, the unemployment rate remains low. According to the BLS, the January 2015 unemployment rate for the insurance industry was 2.3 percent, a much lower rate than the 5.7 percent reported for the national economy. While the insurance industry is enjoying a period of relative stability, the low unemployment rate is lending to the current talent crunch.

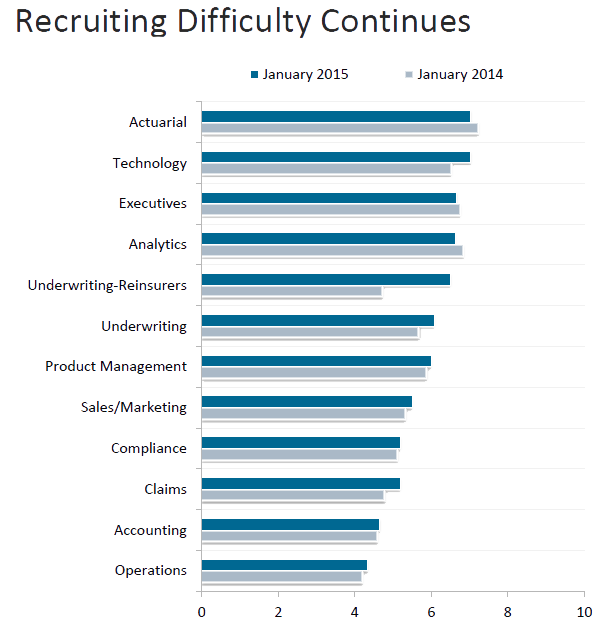

Already companies are reporting a difficult recruiting climate. It is expected that the current labor market will become more and more challenging as the available talent pool continues to be effected by industry retirements and a lack of incumbent talent. Actuarial, technology and executive positions continue to top the list of job functions that are the most difficult to fill. This correlates to the growing focus on technology and analytics within the industry and its increased integration throughout insurance. In fact, technology has had the greatest likelihood of increasing staff in 11 of the past 12 surveys for property and casualty companies.

Already companies are reporting a difficult recruiting climate. It is expected that the current labor market will become more and more challenging as the available talent pool continues to be effected by industry retirements and a lack of incumbent talent. Actuarial, technology and executive positions continue to top the list of job functions that are the most difficult to fill. This correlates to the growing focus on technology and analytics within the industry and its increased integration throughout insurance. In fact, technology has had the greatest likelihood of increasing staff in 11 of the past 12 surveys for property and casualty companies.

To combat the growing talent shortage and meet the growing industry needs, insurance organizations are focused on building their talent pipelines and engaging their current employees. Many insurers are turning toward the incoming wave of Millennial professionals to provide a solution to their talent needs. With Millennials making up an estimated 25 percent of the workforce they present a unique opportunity for the industry to bring in fresh talent. Engaging and recruiting these bright, young professionals may be the key to successfully weathering the growing talent storm.

While things are certainly looking up within the insurance industry, the positive outlook must not be allowed to overshadow the growing challenges in recruiting for key industry positions. Organizations must begin preparing now lest they find themselves unable to meet their growing needs. The key is to think ahead and begin building a bench of emerging insurance talent.

Download the full results from the survey.