The results from our latest Semi-Annual U.S. Insurance Labor Outlook Study are now in! With full employment and positive staffing predictions, the insurance industry is enjoying its return to its pre-recession state.

The results from our latest Semi-Annual U.S. Insurance Labor Outlook Study are now in! With full employment and positive staffing predictions, the insurance industry is enjoying its return to its pre-recession state.

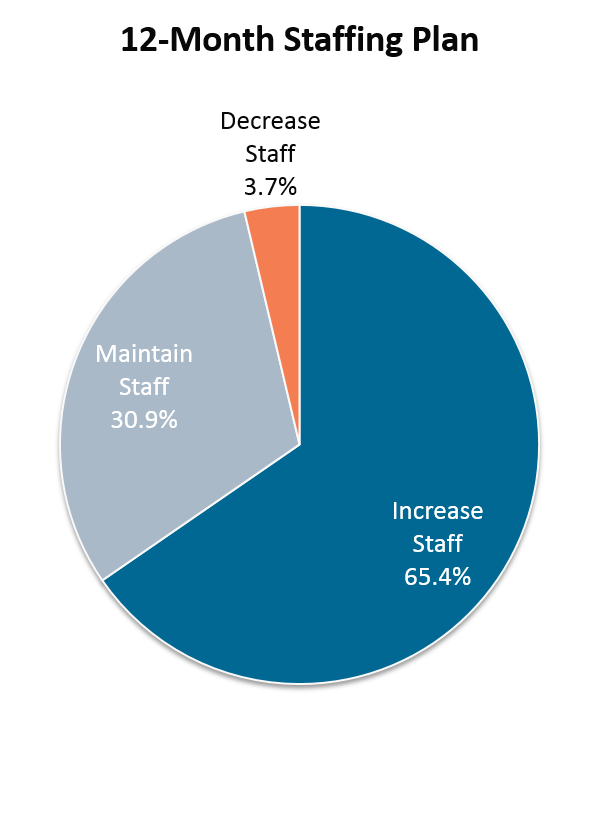

According to the U.S. Bureau of Labor Statistics (BLS), insurance unemployment reached 2.3 percent in August and is expected to hover between one and three percent through the remainder of the year. In addition, the rate of expected hiring has reached the second highest level in the history of the study, with 65 percent of organizations reporting that they are planning to increase their staffs. Further, nearly half of all companies are planning to increase their staffs by at least two percent in the coming year. The primary drivers for this anticipated staffing growth is an increase in business volume and a focus on filling areas that are currently understaffed.

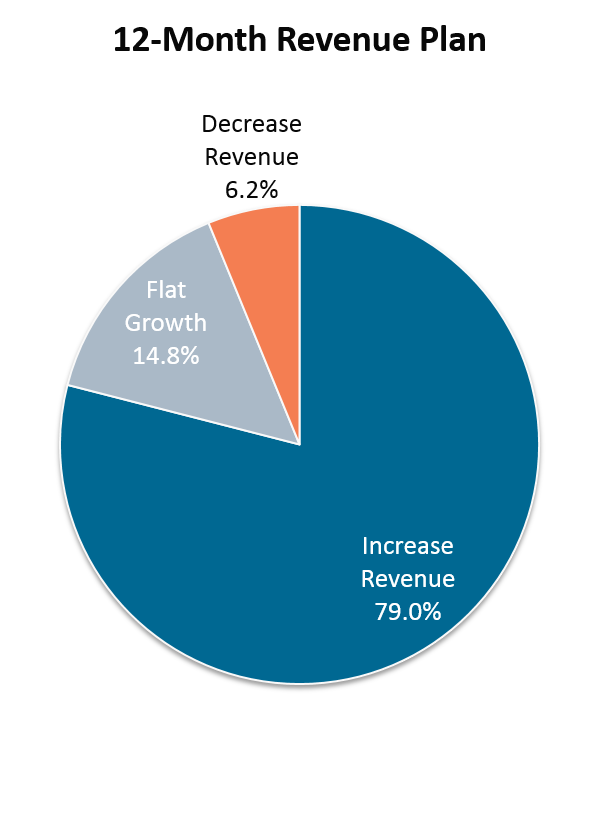

For the first time since 2012, revenue growth expectations dropped below 80 percent. In addition, 6.2 percent of organizations are predicting a decrease in revenue. This is the highest percentage since January 2012, which saw predictions of 11.1 percent. Despite this drop in revenue predictions, organizations are still focused on growing their staffs.

For the first time since 2012, revenue growth expectations dropped below 80 percent. In addition, 6.2 percent of organizations are predicting a decrease in revenue. This is the highest percentage since January 2012, which saw predictions of 11.1 percent. Despite this drop in revenue predictions, organizations are still focused on growing their staffs.

Due, in part, to the fully employed workforce and the continued focus on filling positions, insurers are facing an increasingly challenging recruitment climate. With 1,515,500 individuals currently working in insurance, the industry is seeing employment levels that it hasn’t seen since December 2003. With a to-date average of 231,000 job openings in 2015 alone, it is clear that the demand for talent is far outpacing the supply.

Positions across the board are increasing in recruitment difficulty, with nine out of twelve surveyed roles being reported as moderate to difficult to successfully fill. Currently, actuarial, analytics and executives top the list of job areas most difficult to recruit for.

In light of these growing challenges, insurers are turning to temporary staffing strategies to meet their immediate needs. Despite the economic recovery, the business world has seen temporary employment continue to make waves. Since January 2015, the greater economy has added 52,200 temporary employees. In total, 2,907,700 contract professionals are active in the national workforce. And those numbers are only expected to increase. By 2020, nearly 40 percent of employees in the U.S. will be contingent employees.

In light of these growing challenges, insurers are turning to temporary staffing strategies to meet their immediate needs. Despite the economic recovery, the business world has seen temporary employment continue to make waves. Since January 2015, the greater economy has added 52,200 temporary employees. In total, 2,907,700 contract professionals are active in the national workforce. And those numbers are only expected to increase. By 2020, nearly 40 percent of employees in the U.S. will be contingent employees.

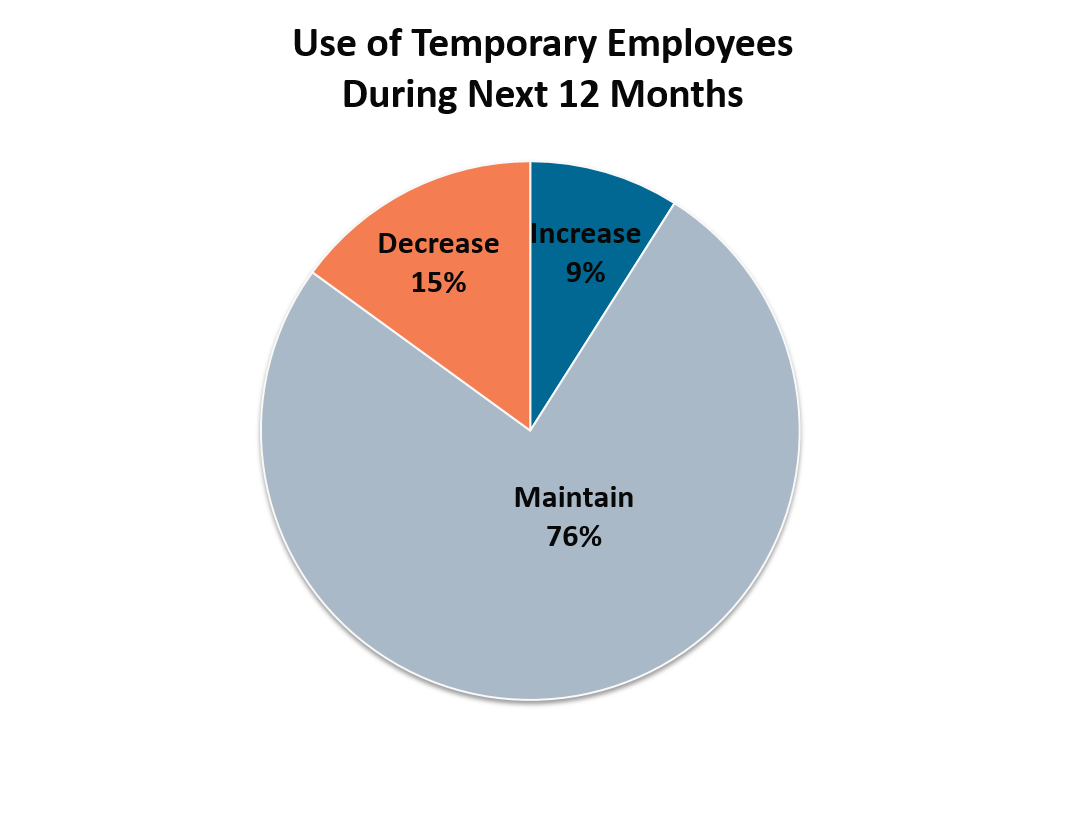

Within insurance, it is estimated that 30,000 temporary professionals are currently employed. As the industry faces a continued talent gap, temporary staffing is proving to be a valuable solution to workload needs. In fact, 76 percent of organizations participating in the recent survey responded that they are planning to maintain their use of temporary employees, a slight drop from the 77 percent reported in July 2014. Despite this dip, this remains the second highest rate in survey history.

With more and more individuals opting for a career as an interim employee, organizations are able to find highly skilled individuals to help them with their high-priority projects and demand spikes. From entry level all the way up to subject matter experts and executives, these individuals are enabling organizations to manage their increasing workloads. As the recruitment climate tightens and organizations feel the pinch, temporary staffing will continue to play a pivotal role throughout the industry.