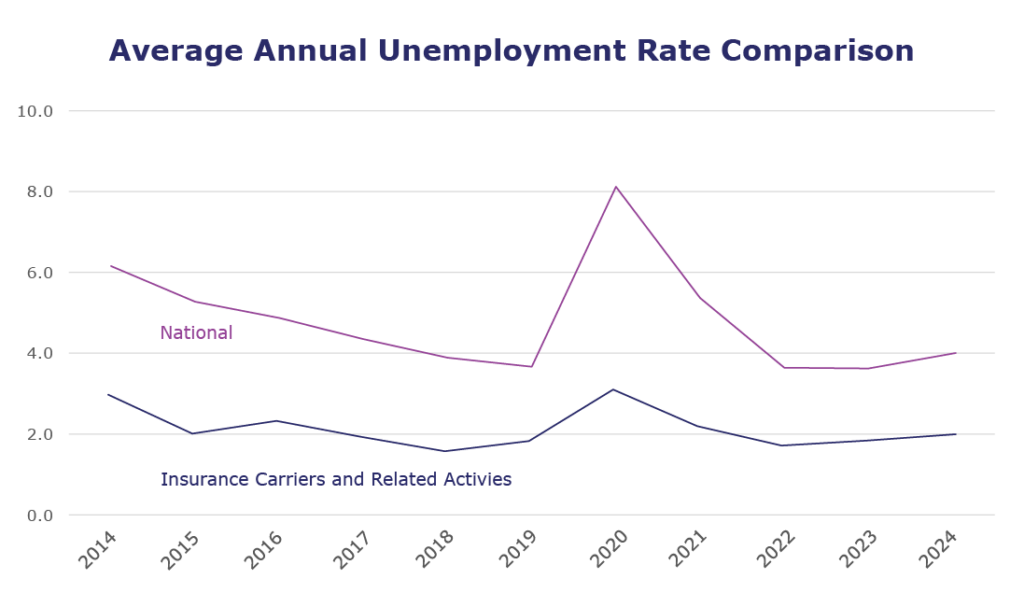

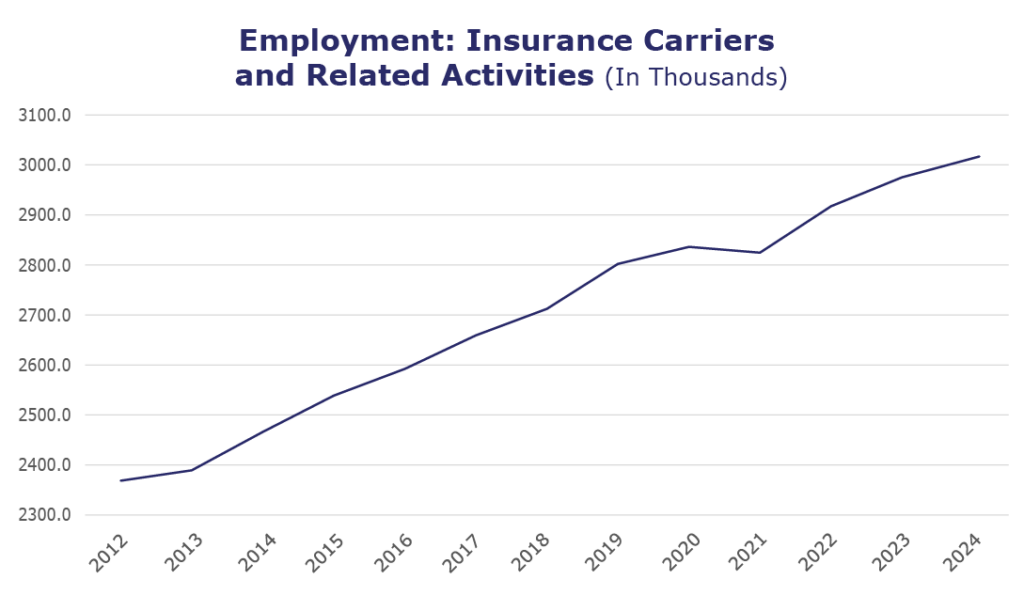

We’re closing out 2024 with a stable labor market. The insurance industry unemployment rate continues to be low and revised numbers from the Bureau of Labor Statistics show 13 consecutive months of employment growth. Additionally, all insurance industry categories we report on saw both weekly wage and employment growth in October*.

Meanwhile, the greater U.S. economy is experiencing an unemployment rate of 4.1%. While still relatively low, this is the first time since 2021 where unemployment has been above 4% for six consecutive months. Jobs continue to be added, with November surpassing many economists’ expectations.

Quits within the finance and insurance industry are also slowing. “The Great Reshuffle” is behind us, making it essential to cultivate productive and loyal employees in 2025. View our recent white paper for insight on combatting quiet quitting and enhancing employee engagement.

| Unemployment for the insurance carriers and related activities sector increased to 2.1% in November. | |

| The insurance carriers and related activities sector gained 5,100 jobs in November. | |

| At more than 3 million jobs, industry employment increased by approximately 41,000 jobs compared to November 2023. | |

The U.S. unemployment rate increased to 4.2% in November and the overall economy added 227,000 jobs. |

- On a year-to-year basis, October* insurance industry employment saw job increases in all categories: agents/brokers (up 3.3%), TPAs (up 1.6%), reinsurance (up 1.3%), title (up 0.7%), life/health (up 0.3%), claims (up 0.3%), and property and casualty (up 0.1%).

- On a year-to-year basis, October* saw weekly wage increases in all categories: TPAs (up 10.1%), reinsurance (up 9.1%), claims (up 7.9%), agents/brokers (up 7.5%), title (up 7.2%), property and casualty (up 3.6%), and life/health (up 1.4%).

BLS Reported Adjustments:

Adjusted employment numbers for October show the industry saw an increase of 1,600 jobs, compared to the previously reported loss of 1,400 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.