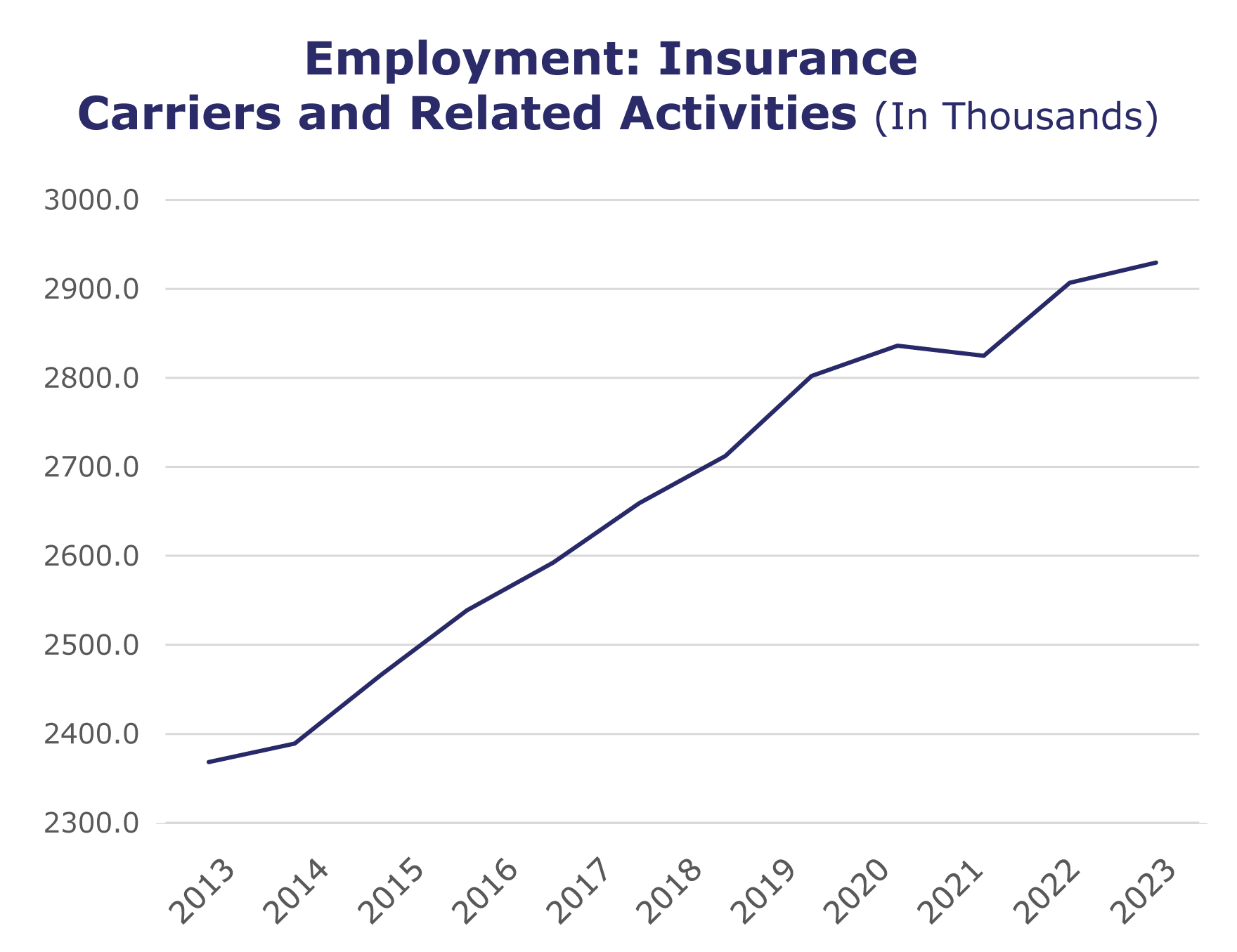

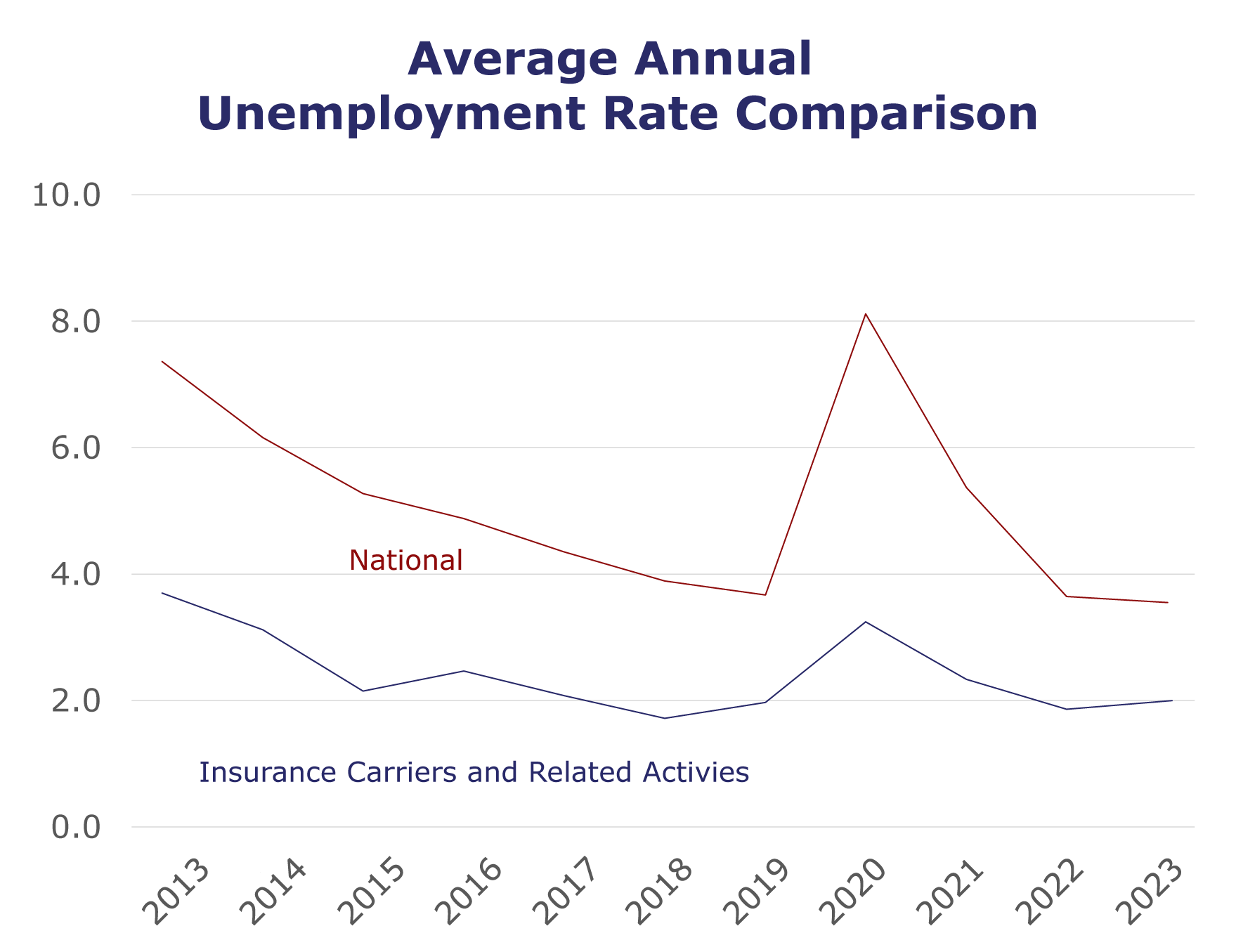

Despite rising costs for health insurance and profitability issues within property and casualty, the industry’s talent landscape remains strong. The unemployment rate for insurance carriers and related activities dropped by more than 1.5 points last month, following a brief spike in June. Industry employment also continues to grow, with the sector adding nearly 30,000 jobs since the beginning of 2023.

For more insight on the current labor market and what insurers can expect throughout the next 12 months, join us for our complimentary Q3 2023 Insurance Labor Market Study results webinar, taking place on Aug. 17 at 1 p.m. CT. Register here: https://jcbsn.gr/2023q3-webinar.

| Unemployment for the insurance carriers and related activities sector decreased to 1.6% in July. | |

| The insurance carriers and related activities sector gained 8,300 jobs in July. | |

| At more than 2.9 million jobs, industry employment increased by approximately 33,900 jobs compared to July 2022. | |

| The U.S. unemployment rate decreased to 3.5% in July and the overall economy added 187,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, June* insurance industry employment saw job increases in reinsurance (up 2.6%), TPAs (up 2.2%), life/health (up 1.6%), property and casualty (up 1.3%), and agents/brokers (up 1%). Meanwhile, job decreases were seen in title (down 9.6%) and claims (down 4.5%).

- On a year-to-year basis, June* saw weekly wage increases in property and casualty (up 10.9%), title (up 6.2%), TPAs (up 6.2%), life/health (up 4%), agents/brokers (up 3.5%) and claims (up 0.9%). Meanwhile, wage decreases were seen in reinsurance (down 6.1%).

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.