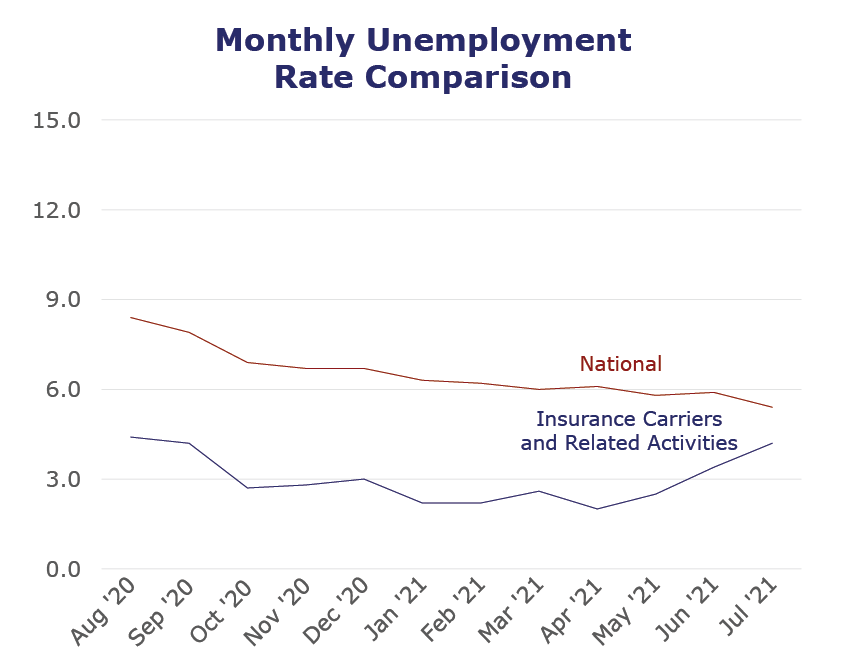

The overall economy saw an optimistic employment report in July, gaining nearly 950,000 jobs and exceeding economists’ predictions. The national unemployment rate is also encouraging, reaching its lowest since the start of the pandemic.

However, the BLS reported continued job losses and a rising unemployment rate for the insurance carriers and related activities sector. While insurance employment is down from June, we’re continuing to see unprecedented activity within the industry. It’s possible these numbers are an anomaly and will adjust in the coming months, as “the Great Reshuffle” begins to settle. Additionally, the findings of our Q3 2021 Insurance Labor Outlook Study, which surveyed carriers across all industry verticals on their hiring plans for the next year, tell a more positive story. Full results of this study will be available in a webinar later this week.

| Unemployment for the insurance carriers and related activities sector increased to 4.2% in July. | |

| The insurance carriers and related activities sector lost 1,500 jobs in July. | |

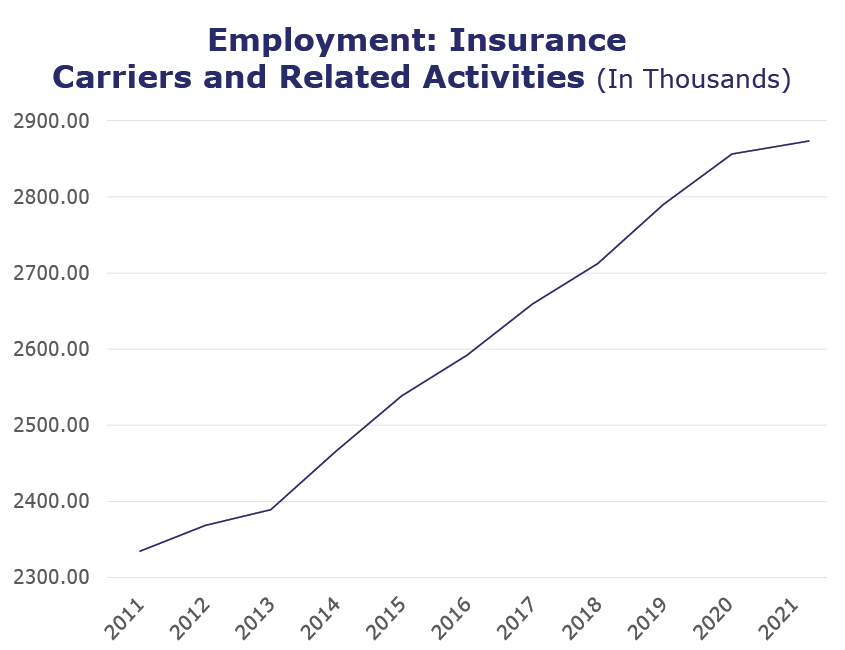

| At roughly 2.9 million jobs, industry employment increased by approximately 8,800 jobs compared to July 2020. | |

| The U.S. unemployment rate decreased to 5.4% in July and the overall economy added 943,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, June* insurance industry employment saw job increases in title (up 17.4%) and agents/brokers (up 2.2%). Meanwhile, job decreases were seen for reinsurance (down 5.5%), claims (down 4.5%), property and casualty (down 2.4%), TPAs (down 1.8%) and life/health (down 0.1%).

- On a year-to-year basis, June* saw weekly wage increases in reinsurance (up 15.3%), agents/brokers (up 3.4%), life/health (up 3.3%) and TPAs (up 0.5%). Meanwhile, wage decreases were seen for claims (down 2.4%), property and casualty (down 1.9%) and title (down 1.3%).

BLS Reported Adjustments: Adjusted employment numbers for June show the industry saw a decrease of 6,300 jobs, compared to the previously reported decrease of 200 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.