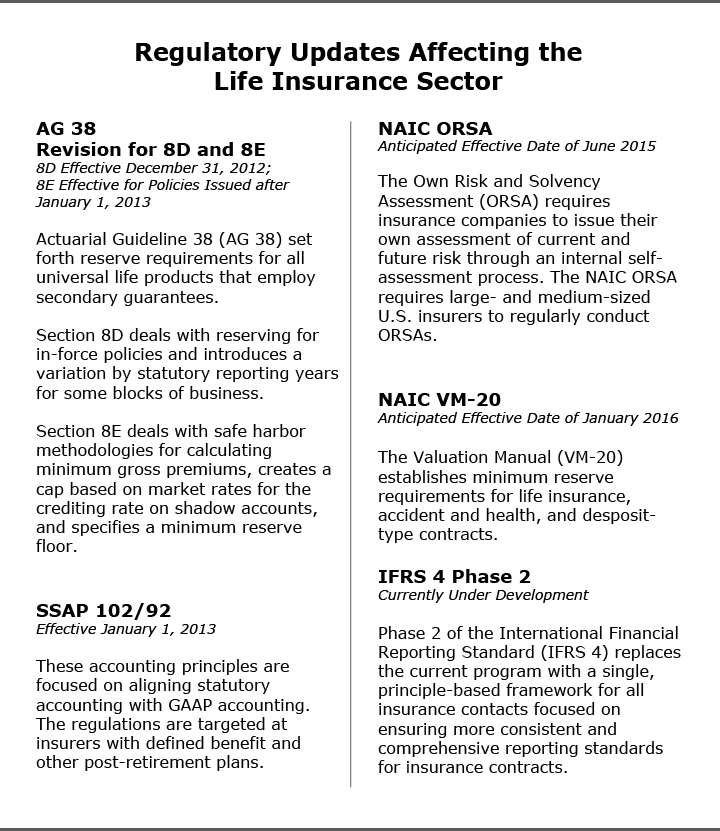

A wave of new regulatory initiatives is hitting the life insurance industry. These reporting requirements are leading many insurers to take a deeper look at their current employees and evaluate their staffing efforts.

According to a study by Towers Watson, merely 27 percent of current life insurance personnel understand the basics of these new regulatory requirements. In addition, only 13 percent of key personnel are considered experts in these new requirements and the changes they will bring. Insurance companies are looking to implement in-house training programs, as well as bring in additional staff with a better grasp of the regulatory changes and compliance needs.

In cases like this, organizations often turn to subject matter experts to bolster their staff and provide much needed project assistance or to implement critical training programs. In fact, here at Jacobson we are witnessing first-hand the increased demand for contract experts with specialized knowledge and skill sets.

According to our recent Semi-Annual U.S. Insurance Labor Outlook Study, 28% of life and health companies are planning to increase their use of temporary employees during the upcoming year, an increase from what was reported a year ago. For companies needing assistance with the upcoming regulatory requirements the minimal ramp-up time, quick deployment and specialized skill set offered by subject matter experts are proving attractive.

How is your organization preparing for these pending changes in regulation?