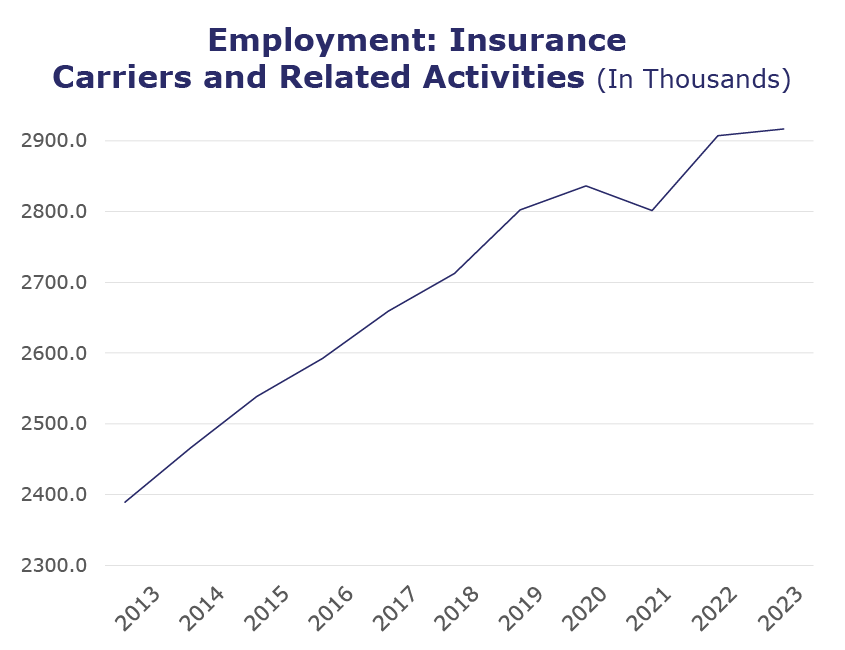

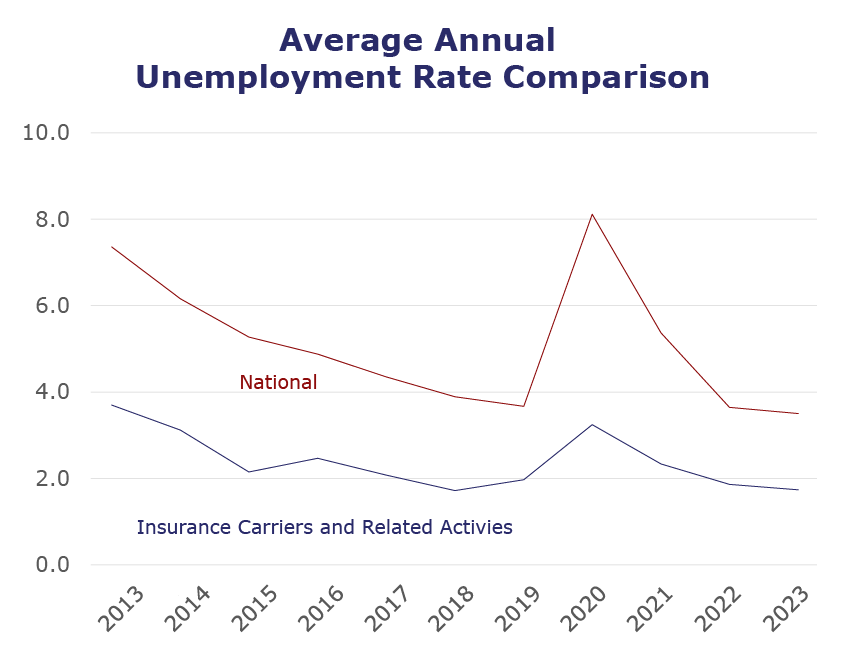

Entering the second quarter of 2023, the insurance labor market remains relatively constant. The industry unemployment rate is low at 1.5%, and insurance employment is steady, boasting nearly 32,000 more jobs than one year ago. Finance and insurance job openings dipped slightly in February*, to 350,000; however, while this number is lower than last year’s annual monthly average, it is still notably higher than pre-pandemic levels.

| Unemployment for the insurance carriers and related activities sector slightly increased to 1.5% in March. | |

| The insurance carriers and related activities sector gained 4,300 jobs in March. | |

| At roughly 2.9 million jobs, industry employment increased by approximately 31,900 jobs compared to March 2022. | |

| The U.S. unemployment rate decreased to 3.5% in March and the overall economy added 236,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, February* insurance industry employment saw job increases in property and casualty (up 3.2%), TPAs (up 2.5%), reinsurance (up 2%), life/health (up 1.6%), and agents/brokers (up 1.2%). Meanwhile, job decreases were seen in title (down 11.5%) and claims (down 7.9%).

- On a year-to-year basis, February* saw weekly wage increases in property and casualty (up 11.7%), title (up 5.5%), life/health (up 5.2%), TPAs (up 4.1%), agents/brokers (up 3.2%), claims (up 2.5%). Meanwhile, wage decreases were seen in reinsurance (down 2.3%).

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.