It seems that 8:30 AM Eastern Time on the first Friday of the month has become the most newsworthy moment of the news cycle. This is, of course, the exact moment (in most months) when the BLS releases its Employment Situation Report and the market goes into a temporary frenzy… albeit a weird one these days where bad news (non-improvement in the unemployment rate) typically leads to a rally and good news typically leads to a sell-off.

It seems that 8:30 AM Eastern Time on the first Friday of the month has become the most newsworthy moment of the news cycle. This is, of course, the exact moment (in most months) when the BLS releases its Employment Situation Report and the market goes into a temporary frenzy… albeit a weird one these days where bad news (non-improvement in the unemployment rate) typically leads to a rally and good news typically leads to a sell-off.

So lately the news hasn’t been so great – a 7.6% and seemingly unbudging unemployment rate and a labor participation rate at or near multi-generational lows. The broader U6 rate (which includes discouraged workers who no longer actively seek employment, marginally attached workers and part-time workers seeking full-time employment) puts the unemployment picture in stark perspective.

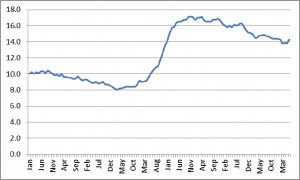

Here is the tough thing to explain. We’re busy. Really busy. Like 2007 busy. And it’s not just us. If you've seen our July Pulse, you no doubt noticed that insurance industry employment is nearing its mid-2008 peak. Meanwhile, our clients are telling us that roles requiring knowledge and experience are getting harder and harder to fill. Well, as Paul Harvey would say, "here’s the rest of the story..."

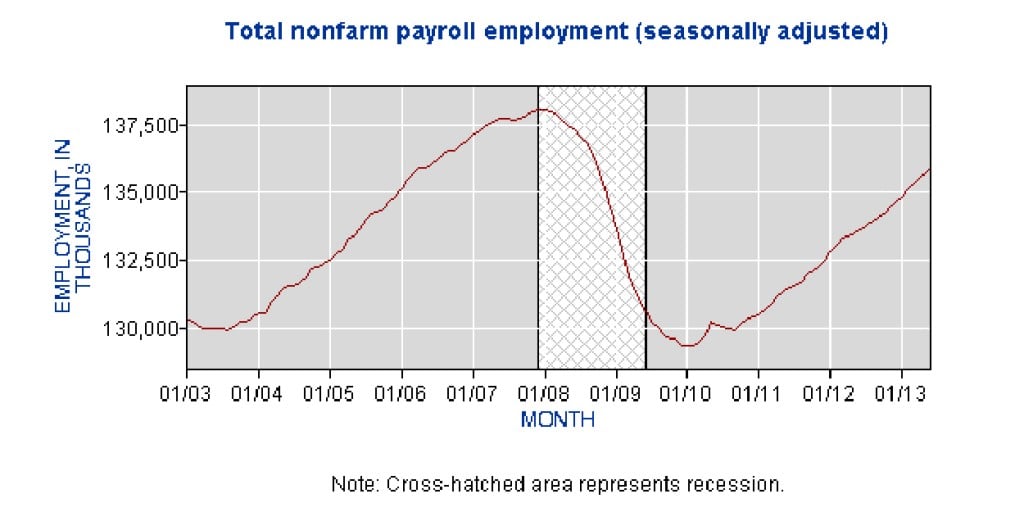

First, you all no doubt know that unemployment and employment measure very different things. The widely reported U3 rate (7.6 percent, currently) measures “…the proportion of the civilian labor force that is unemployed but actively seeking employment,” while total employment measures the number of individuals working. View the total non-farm employment picture from the BLS below.

While the jobs picture has improved markedly from the depths of the recession and total jobs are nearing the peak seen in 2008, the population has increased from 298M in 2007 to 315M; thus, there are quite a few more unemployed people. We can see from our July Pulse that the insurance industry is following a roughly similar path.

But we still haven’t explained what feels like a tightening labor market in our industry.

A quick search of the BLS data can shed light on the changing labor market conditions. As can be seen, the median age of workers in the insurance industry is currently 45.0 compared to 42.3 for the overall economy and 43.5 (imputed from the BLS data presented) for the rest of the financial industry. Furthermore, a look at average tenure with current employer by industry shows just how much our industry relies upon seasoned, tenured professionals. With an average tenure of 5.7 years, the insurance industry is far more tenured, on average, than the overall economy (4.6 years) and the rest of the finance industry (also 4.6 years). One of the primary reasons that the industry labor market seems so tight is that its employees are older and more tenured than the rest of the U.S. economy, and even than the rest of the finance world.The bad news is that the issue is getting worse. Only 26.67 percent of the insurance industry’s workers are under the age of 35. This number also compares unfavorably to the overall economy (34.07 percent) and the non-insurance finance community (30.66 percent). We are not bringing enough new talent to the industry.

Well, Jacobson is committed to doing whatever we can to help solve this talent crunch. Last week, we made a major announcement regarding a new service offering and it is receiving a great deal of traction. Our emerging talent service offering provides insurers with promising young professionals and recent graduates with an expressed interest in the insurance industry for direct hire, temporary and temporary-to-hire positions. We are excited to play our part in offsetting the skills gap by guiding bright, new talent to our clients’ doorsteps. I invite you to learn more about this new service here.