Competition for talent continues, with job openings in finance and insurance reaching a record level of 401,000 in June*, surpassing January’s revised record of 376,000 (originally reported as 411,000) and contributing to an average level of 367,000 open roles for 2022 so far. Comparatively, the same timeframe in 2021 (January through June), saw an average of just 252,000 open positions.

For additional insights on insurers’ hiring plans for the next 12 months, join us for a complimentary webinar on August 11, discussing the results of the Q3 2022 Insurance Labor Market Study. Register here.

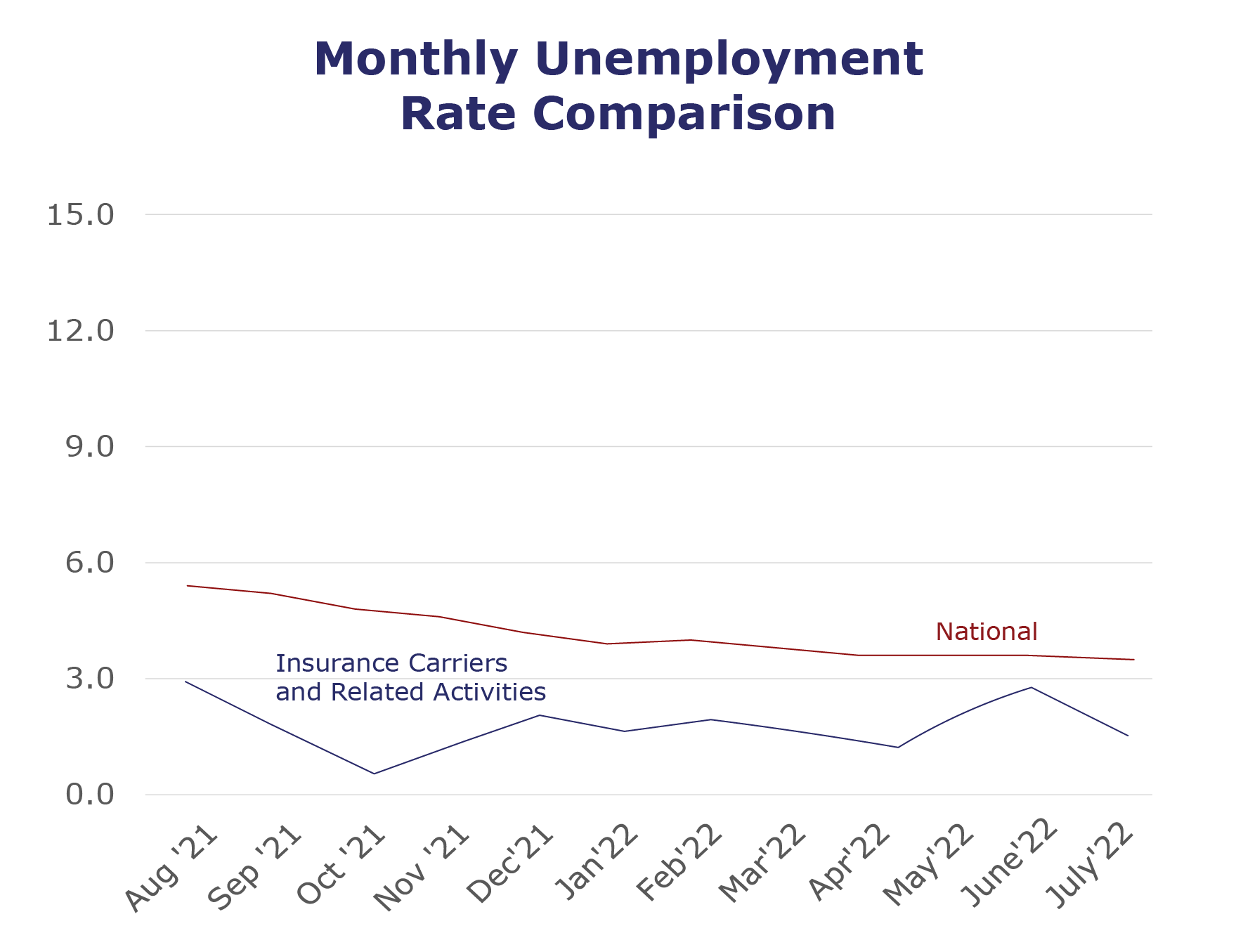

| Unemployment for the insurance carriers and related activities sector decreased to 2.1% in July. | |

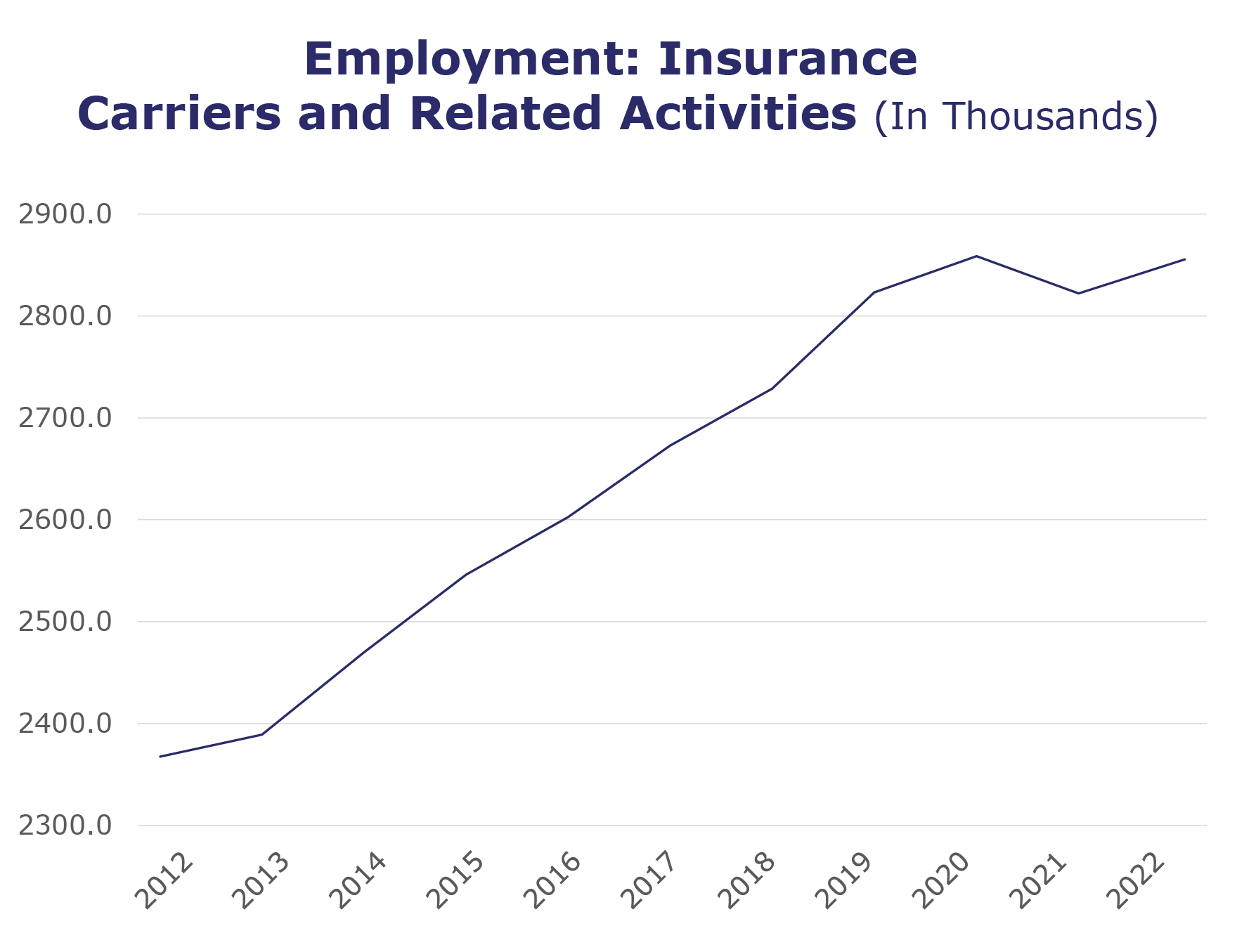

| The insurance carriers and related activities sector gained 6,200 jobs in July. | |

| At roughly 2.8 million jobs, industry employment increased by approximately 50,800 jobs compared to July 2021. | |

| The U.S. unemployment rate decreased to 3.5% in July and the overall economy added 528,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, June* insurance industry employment saw job increases in agents/brokers (up 4%), TPAs (up 3.3%), title (up 1.1%), property and casualty (up 0.3%), and life/health (up 0.2%). Meanwhile, job decreases were seen in claims (down 2.2%) and reinsurance (down 1.1%).

- On a year-to-year basis, June* saw weekly wage increases in property and casualty (up 8.3%), claims (up 6.3%), title (up 5.3%), life/health (up 5.1%), agents/brokers (up 3.6%), and TPAs (up 2.9%). Meanwhile, wages decreased in reinsurance (down 3.3%).

BLS Reported Adjustments: Adjusted employment numbers for June show the industry saw an increase of 8,600 jobs, compared to the previously reported increase of 7,200 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.